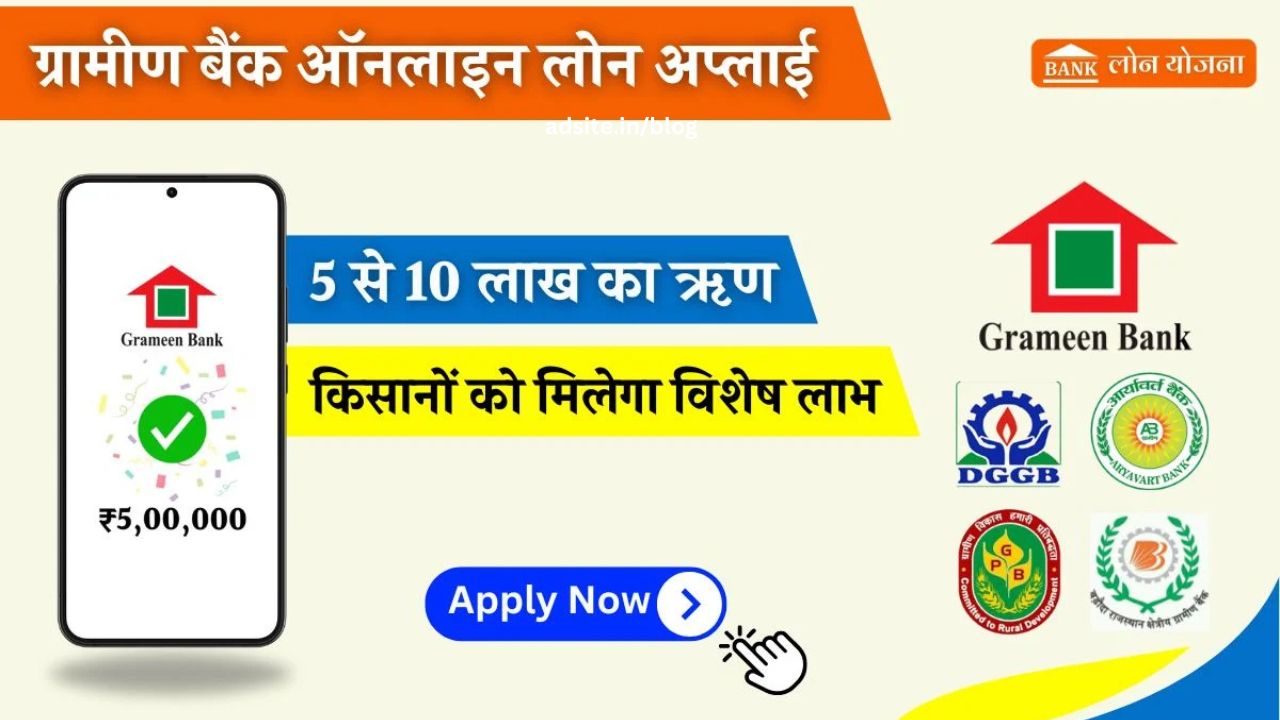

Gramin banks are financial institutions run by government and private banks, which provide loans and other financial services especially for people residing in rural areas. There are different Gramin banks operating in each state, which provide their services according to the needs of the state. You can take loans from this bank on any of the following types of loans like personal loan, agriculture loan, business loan, home loan and car loan etc. The main objective of this bank is to strengthen the economic condition of the people of rural areas. All the rural people can take loans as per their requirement.

loan from gramin bank

To get a loan from a rural bank, you have to choose a special type of bank, called a regional rural bank. These banks were established to help people living in rural areas. The main objective of rural banks is to strengthen the rural economy by providing loans and other assistance to farmers, laborers, artisans and small businessmen living in villages.

Types of banks

- NRI Loans

- Top Up Loan

- Personal Loan Balance Transfer

- Home Renovation Loan

- Holiday Loans

- Latest Funding Loans

Eligibility for Gramin Bank

- He must be a native citizen of India.

- The age of the applicant should be minimum 21 years and maximum 60 years.

- His CIBIL score should be more than 700.

- You must be working in any government or private organization.

- Your Aadhar card should be linked to the mobile number.

- KYC documents of your account must be complete.

Gramin Bank Required Documents

- Aadhar card

- Income Certificate

- Address proof

- Caste Certificate

- Bank account number

- Mobile Number

- salary slip

- Passport size photo

- Occupation Certificate

How to apply online in Gramin Bank

- First of all go to the official website of Gramin Bank.

- After that choose the option of Gramin Bank Home Loan Apply.

- Now you have to click on Personal.

- Choose the type of loan you want from a variety of loan options.

- Click on Advantage SBI option.

- After that a new page will open in front of you, in which you will see the application form.

- Fill all the information asked in the form and submit it.

- After this, we will check the information given by the bank and proceed with the loan process as per your phone.

Frequently Asked Questions Related to Gramin Bank

How much loan can I get from Gramin Bank?

The minimum loan amount that can be sanctioned is Rs 10,000. The maximum loan amount that can be sanctioned is Rs 5,00,000. The tenure can be from the month following the month in which the amount is disbursed to 60 months. No collateral is required for loans up to Rs 25,000.

How much interest does Grameen Bank give?

In Madhyanchal Gramin Bank, 2.75% annual interest is available on deposits up to Rs 25 lakh. In Madhyanchal Gramin Bank, the maximum rate of FD for general citizens is 7% per annum. Whereas, for senior citizens this rate is 7.5% per annum.

What should be the minimum balance in Gramin Bank?

Customers with savings accounts in semi-urban areas and rural areas are required to maintain a minimum balance of Rs 5,000 and Rs 2,000 per month respectively. Customers who have opened regular savings accounts in rural areas are required to maintain an average balance of Rs 1,000 per month.